Your finances depend much on your CIBIL score. Your credit score could, however, influence your loan, credit card, or mortgage acceptance. Better loan terms follow from higher CIBIL scores. Low credit ratings can stop credit from flowing. Understanding CIBIL scores, how they are computed, how to validate them, and most importantly, how to raise them is absolutely vital. Read this to protect your financial future. It covers all aspects of your CIBIL score, from knowledge to enhancement.

What is the CIBIL Score?

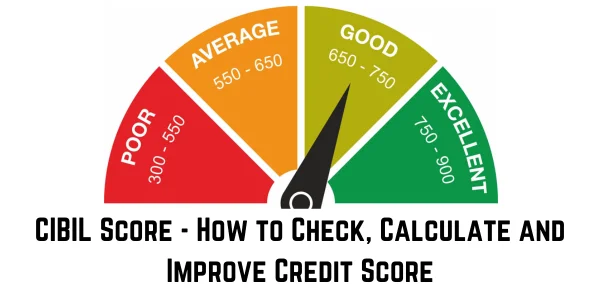

Three-digit CIBIL scores, which show your creditworthiness—that is, probability of loan repayment—are In the 300–900 range; a score above 750 is regarded as good. One of India’s most famous credit companies is CIBIL. Financial firms check credit histories using CIBIL scores. High CIBIL scores make you more trustworthy to lenders. You may receive low-interest loans. Your score depends on your credit history, debt, and repayment history.

How to Check Your CIBIL Score

- Visit CIBIL’s Official Website

Free credit report download on the company’s website is easy. Site members can obtain free credit reports once a year. To obtain a full report, you must register and provide personal information such as your birthdate, address, and email.

- Contact your lender or bank.

Many banks and financial organizations display credit scores. Bank websites and apps allow you to check your credit score for free if you conduct business with them. This is an excellent choice if you have an account.

- Use money applications and websites

You can find your CIBIL score on BankBazaar, Paisabazaar, Bajaj Markets and other banking websites and apps. Some offer free reports with limited information, while others need membership. You should compare services to choose the best one.

How to Calculate CIBIL Score

- Payment history

Your prior bill payment history determines most of your CIBIL score. This score indicates timely loan and credit card payments. Late payments and loan defaults might lower your score. Repeatedly paying on time displays money management, which boosts your reputation.

- Credit Usage Ratio

This displays your current cash use. If you utilize more than 30–40% of your available credit, your CIBIL score may drop. Low credit usage shows lenders you are responsible with credit.

- Credit kind, duration

Personal, credit, and housing loans, along with their duration, might potentially damage your credit score. Mix monthly and revolving credit for improved credit. Have more extended credit history. Lenders want long-term borrowers who can handle various debts.

- Credit checks

Every time you apply for credit, lenders hard-search your credit score. Multiple quick inquiries might lower your score since they indicate financial instability or a desire for credit. One question may not matter, but too many in a short period will harm your score.

- Outstanding Debt

Your credit card, loan, and mortgage debt affect your CIBIL score. If your debt exceeds your income, your score may drop. Keep your debt manageable and reduce your owing bills.

How to Improve Your CIBIL Score

- Make Timely Payments

Paying on time is one of the finest ways to boost your CIBIL score. This group includes credit card, loan, and utility payments. Pay overdue dues as quickly as possible to avoid further credit damage. Regular payments help you keep on track.

- Pay off all credit cards.

If you max up your credit cards and pay the minimum, your CIBIL score will drop. Consider paying off all credit card debts monthly. Can’t do that? Stay below 30% of your credit line. Your credit utilization ratio will improve.

- Reduce debt

Paying bills carefully is crucial. As fast as it is practical, pay off high-interest credit cards and personal loans. Less debt will raise your credit score and lower your debt-to—income ratio, therefore increasing your creditworthiness to lenders.

- Maintain old accounts

Closing unused credit accounts might lower your CIBIL score. Keeping previous accounts active might boost your credit score because part of it is dependent on your credit history. If you close an account, make sure it has a limited credit limit or significant fees.

- Don’t accept new credit applications

Applying for too many loans too rapidly will harm your CIBIL score. Every application has a challenging question, and too many might indicate money stress. Avoid applying for many loans when you need credit. Only apply for new credit if you need it—it might damage your score.

- Dispute Errors on Your Credit Report

A few credit report errors might reduce your score. Please notify the credit company of any mistakes, such as incorrect payment records or settled invoices. Fixing them might boost your score.

Conclusion

A strong CIBIL score helps you receive loans and manage your money. When you check, calculate, or strive to improve your credit score, know what impacts it and be proactive to maintain or increase it. Making payments on time, utilizing less credit, and managing debt wisely might steadily boost your CIBIL score. Your credit score might also benefit by avoiding requesting credit when you do not need it and from looking for errors. Improving your CIBIL score will pay off in terms of your financial future. Hence, the time and effort required is well justified.